31st October 2024

Following the announcement of the budget on 30th October 2024, individuals or companies purchasing additional residential property, such as second homes or buy-to-let properties, in England and Northern Ireland will now be subject to an additional increase on higher rate Stamp Duty Land Tax from 3% to 5%, which is effective from today, 31st October 2024.

There is also an increase in the single rate of Stamp Duty Land Tax payable by companies and other non-natural persons (any other corporate body) when purchasing residential properties worth more than £500,000.00, from 15% to 17%.

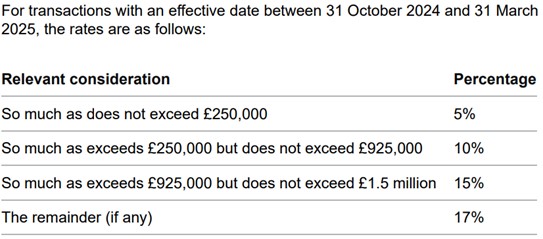

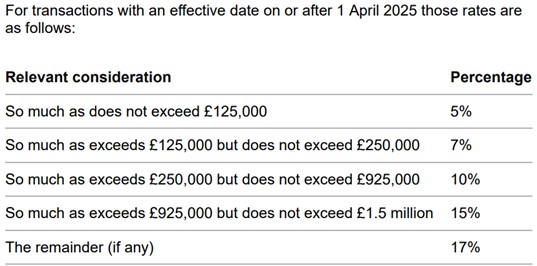

The government has announced that legislation will be introduced in the Finance Bill 2024-2025 to confirm the higher rates as follows:

As the changes are in force effective immediately, if you are purchasing a property which is classed as a second property or a buy-to-let, you will be applicable to pay the new higher rate Stamp Duty. Therefore, if you are in the process of such a transaction, please ensure you check with your Solicitor the new rates you will be liable to pay.

If you are looking to purchase a second home or a buy-to-let property and would like to discuss any of the above, please feel free to give us a call on 01325 466794. We have a variety of Property Lawyers on hand to assist.

Sara Khan

Sara Khan

Chartered Legal Executive Lawyer